Create Business Value by Strengthening Your ESG Efforts

February 10, 2022

For many of those very same stakeholders, a company’s sustainability report is a future-facing signal that the company is doing more than measuring its success by self-serving metrics. It demonstrates that a company is concerned about sustainability, but also that it values transparency and accountability in its operations—elements vital to building confidence in a brand for great swaths of the public.

Reporting on ESG has become de-rigueur for the modern corporation and might become legally required in some cases. In response, an industry of sustainable solutions partners has arisen to greater prominence in today’s market to help companies without the in-house resources or expertise to plan, implement, measure, and report on their ESG standings.

A key component that stakeholders seek, and a challenge that sustainable solutions partners can help companies surmount, is making metrics standardized, accurate and accessible. Right now, ESG measurements lack uniformity, and it’s difficult to look across companies or industries to measure or describe progress in meaningful ways. What’s more, accurately acquiring those metrics in the first place isn’t always possible for companies whose primary business functions do not encompass waste and resource management, or other sustainable solutions.

ESG and the Financial Markets

The vaunted management consulting firm McKinsey and Co links getting ESG right to higher value creation along five specific value metrics: top line growth, cost reductions, regulatory and legal interventions, productivity lift, and investment/asset optimization.

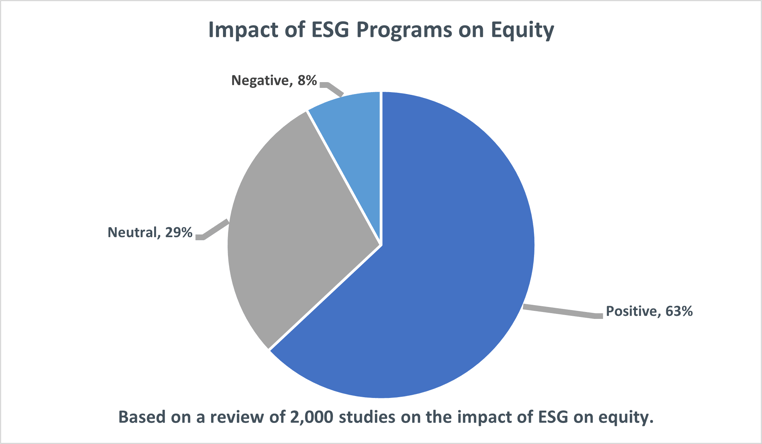

In their 2019 report “Five Ways that ESG Creates Value ,” McKinsey reviewed 2,000 studies on the impact of ESG on equity. What they found was an overwhelming majority of findings were positive. 63% reported their ESG investment had a positive impact on equity and only 8% said it had a negative impact.

It’s clear that investors are paying attention. A 2018 Morgan Stanley study of 120 institutional investors found that 70% had already integrated sustainable investment criteria with another 14% actively considering it. A later study by BNP (Banco Nacional de Paris) asked institutional investors to rank their top-three drivers for incorporating ESG into their investment strategy. They found that the main drivers of ESG-conscious investors were Improved Long-term Returns (52%), Brand Reputation (47%), and Decreased Investment Risk (37%). Clearly, these investors see ESG as a big positive.

ESG and Customers

From a brand perspective, ESG can be an even more solid win. A 2022 report from risk and compliance management software company NAVEX surveyed 1,250 managers and executives at companies with more than 500 employees on their ESG activities. Results show that 83% of respondents say that their ESG program impacts their brand’s reputation. ESG management firm Goby says that, of the 50 top-performing companies in the S&P 500, nearly three-quarters (74%) score above the median on their ESG Measures.

Similarly, EY’s 2022 US CEO survey found that 73% of CEOs have adopted ESG strategically. This is a significant increase from the 43% who saw ESG as strategically important in 2019. ESG issues are even influencing mergers and acquisitions. Traditionally companies have turned to M&A to grow market share and acquire technology. The EY survey found that a quarter of CEOs view their ESG ranking as a top impetus for acquisitions.

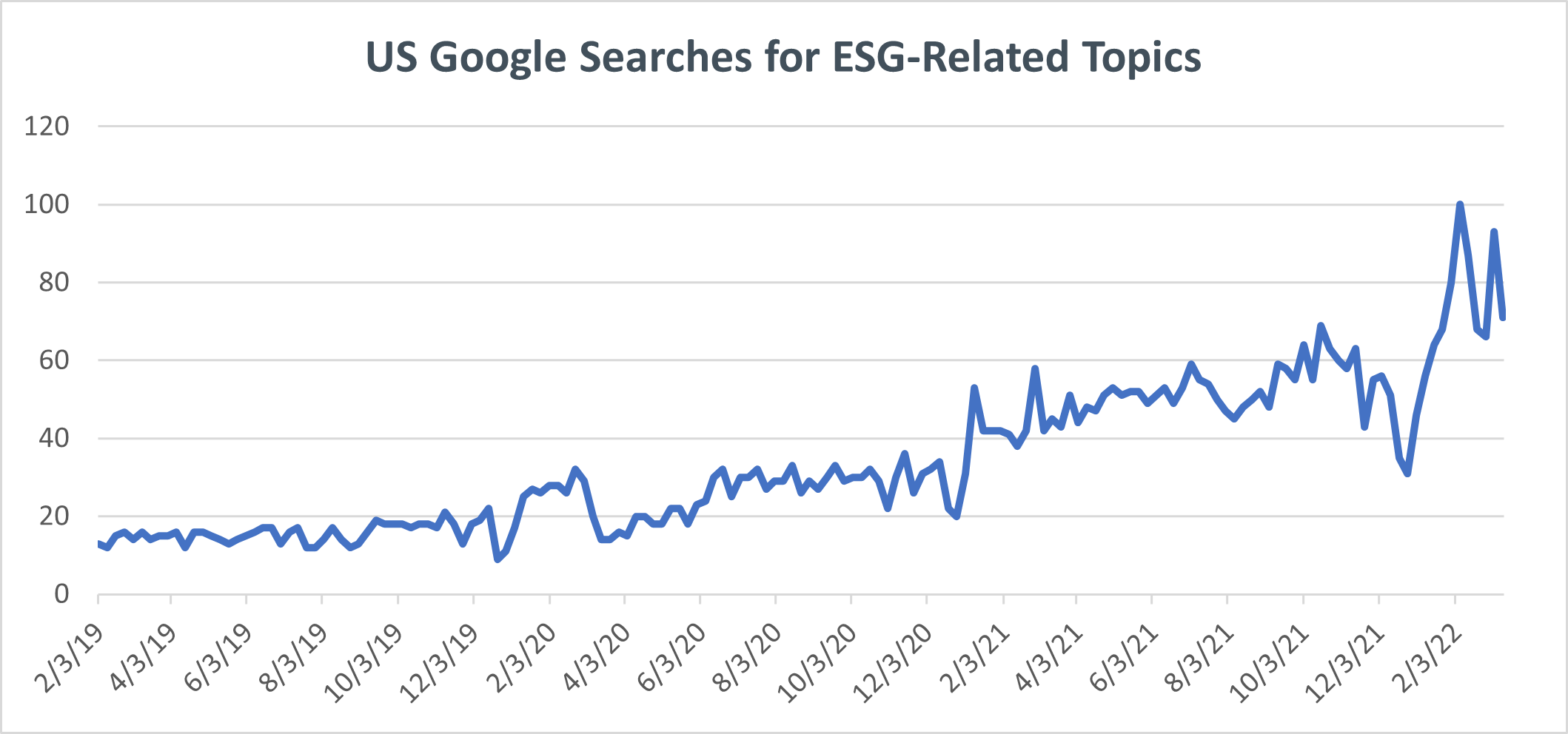

And it’s not just the corporate elite who are interested in ESG. Google Trends, a service which ranks search terms over time and is often cited as a proxy for public opinion, shows that Google has seen a 5x increase in ESG-related searches worldwide in the past 3 years. The increase has been even greater in the United States, where searches increased by more than 6.5x in the same time period.

Google searches for ESG-related topics increased 6.5x in the US in the past three years.

Google searches for ESG-related topics increased 6.5x in the US in the past three years.

ESG and Employees

Evidence abounds that the broad array of topics that make up ESG provides companies with a powerful way to attract and retain top talent.

Attracting and retaining top talent is a driving force among today’s employers and ESG programs are proving to be a litmus test for companies. Research shows that ESG programs tick a lot of the boxes that employees – both current and future – look for in a positive work environment.

The MarshMcLennan study “ESG as a Workforce Strategy” found a correlation between a company’s ESG scores and appeal among students and young professionals. This cohort finds companies with ESG scores 25% higher than the global average to be most attractive.

In fact, Barron’s reports that employee turnover at their list of America’s Most Sustainable Companies is 25% to 50% lower than the average US company. And the trend is expected to continue as Millennials and GenZ become a majority of the workforce.

ESG and the Federal Government

If there’s one constituency that doesn’t care about branding, it’s the federal government. In the United States, the Securities and Exchange Commission has proposed rules that will force companies to address their ESG programs, particularly the environmental and governance components. If the 510-page rule passes – the amendment passed its first hurdle by a 3:1 margin—public companies in the United States (domestic and foreign) will be required to report on:

- Climate-related risks on a business’s outlook and strategy

- Governance of climate-related risks and relevant risk management processes

- Greenhouse gas emissions: direct emissions (those they emit themselves), indirect emissions (those associated with the energy they buy), and even those emissions caused by their supply chain and value chains

Public companies, whether they see the enormous values that ESG brings them or not, will see ESG become a must-have to be in compliance with the SEC. While this may seem to some like government overreach, the reality is that, in 2020, 92% of the S&P 500 already published sustainability reports, according to the Governance and Accountability Institute.

ESG and Reporting Standards

Companies already face a lot of pressure to engage in sound Environmental, Social and Governance practices. Investors, employees and customers all use ESG as a metric for their own specific worldview. As ESG reporting moves more and more into becoming a compliance issue as well, standardization of reporting becomes important so companies can report their results uniformly.

There is some movement toward globalizing reporting standards, a number of reporting frameworks are already available to advise companies on what–and how–to report.

- SASB: identifies a number of sustainability risks and opportunities for companies

- Global Reporting Initiative (GRI): provides a reporting tool that helps organizations communicate the impact of their ESG program

- CDP: a ranking non-profit that ratings for participating companies’ reporting on greenhouse gases and water usage

Many sources refer to the current state of ESG reporting as alphabet soup, rife with the opportunity to pick and choose which elements to include in a report. The so-called greenwashing is designed to paint a company in its best possible light.

But the real challenge that companies face is building out the expertise to plan, create, and manage programs that comply with the market and forthcoming regulatory needs. Most organizations simply don’t have the in-house resources to accurately measure their material usage and don’t have the context to assess the short- and long-term impacts of those materials. No matter what business a company is in, it’s more than likely outside its scope to also know how to create sustainable programs.

ESG and Strategic Partnerships

This is where third-party sustainable solution partners offer tangible value. Since their business is sustainable solutions, they can create programs that not only accurately capture your efforts' metrics, but also use their capabilities and expertise to improve them. After all, a good partner will value ESG reporting themselves. For customers, that means concrete, well-documented and well-supported achievements that provide timely insights, simplify reporting and information sharing, conserve resources, and strengthen brand image.

With the high value placed in accurate ESG reporting and the undeniable benefits that result from it, pursuing such an endeavor without the right help is simply too big of an opportunity to miss.

For more details on how partnering with the right sustainable solutions provider can greatly benefit the process and outcome of your ESG reporting, be sure to read our eBook.