Covanta Holding Corporation Reports 2021 Second Quarter Results

July 28, 2021

MORRISTOWN, N.J. – Covanta Holding Corporation (NYSE: CVA) ("Covanta" or the "Company"), a world leader in sustainable waste and energy solutions, reported financial results today for the three and six months ended June 30, 2021.

Key Highlights

- Adjusted EBITDA up $14 million (15%) year-over-year

- 8.0% year-over-year waste-to-energy tip fee price growth

- Metals markets remain strong and energy markets improving

- UK construction and commissioning activities on track

“We are seeing broad-based momentum in the business, as waste markets have recovered strongly and commodity prices continue to firm,” said Michael Ranger, President and CEO. “Operationally, we are executing on plan, with the fleet running at high levels of availability and production following a successful spring outage season. With the announced transaction with EQT, we remain focused on our mission to provide sustainable waste and energy solutions for our customers and communities, and are excited about the opportunities for growth in the company's next chapter.”

Fiscal Year 2021 Guidance and Upcoming Investor Communication

In light of the announcement of a definitive agreement with EQT to purchase Covanta at $20.25 per share, the Company will no longer update forward looking guidance and will discontinue quarterly earnings conference calls. The transaction is expected to close during the fourth quarter of 2021, subject to customary closing conditions including approval by the majority of the holders of Covanta's outstanding common shares.

Discussion of Second Quarter 2021 Results

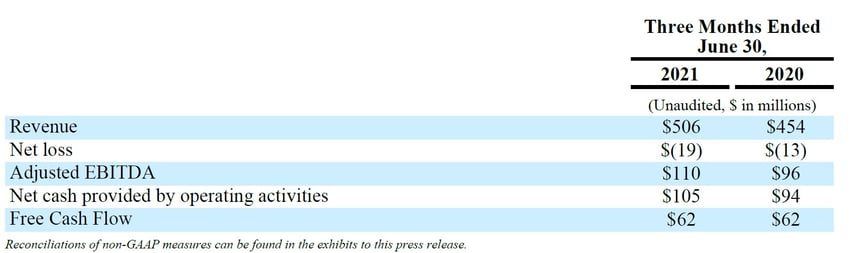

Total revenue for the three months ended June 30, 2021 was $506 million, up $52 million as compared to the prior year period, driven by the following:

- Waste revenue improved by $27 million, with growth in nearly all areas, including:

- Tip fees up $11 million (7%) on higher prices;

- Service fees up $8 million (7%) primarily due to higher plant throughput; and

- Material processing and recycling revenue up $8 million with the strong recovery in demand in our environmental services business;

- Energy revenue increased by $8 million due to higher market prices, increased electricity sales volumes and increased revenue from renewable energy credits; and

- Materials sales increased by $18 million, with a $13 million increase in ferrous revenue on higher market prices and a $6 million increase in non-ferrous revenue due to both market prices and higher sales volume.

Total operating expenses were $481 million in the quarter, up $45 million over the prior year period, driven by the following:

- Wages and benefits rose by $17 million, with normalized compensation costs compared to

COVID-related cost mitigation actions taken in the second quarter of 2020 and higher accruals for incentive compensation based on financial performance; - Maintenance expense increased by $8 million due to the timing of planned outage activity;

- Other operating costs increased by $14 million primarily related to higher waste volumes in the quarter, including higher costs for hauling, disposal, chemicals and reagents; and

- General and administrative expense rose by $6 million, with the cost mitigation actions taken in the prior year period impacting the comparison.

Adjusted EBITDA increased by $14 million to $110 million, driven primarily by higher waste and commodity prices, partially offset by higher costs compared to the prior year cost mitigation program and heavier planned maintenance expense.

Free Cash Flow was $62 million in the quarter, effectively unchanged compared to the prior year, as higher Adjusted EBITDA was offset primarily by higher planned maintenance capital expenditures.

The Company ended the quarter with $2.5 billion of net debt outstanding and a leverage ratio of 5.8x.

About Covanta

Covanta is a world leader in providing sustainable waste and energy solutions. Annually, Covanta’s modern Waste-to-Energy ("WtE") facilities safely convert approximately 21 million tons of waste from municipalities and businesses into clean, renewable electricity to power one million homes and recycle 600,000 tons of metal. Through a vast network of treatment and recycling facilities, Covanta also provides comprehensive industrial material management services to companies seeking solutions to some of today’s most complex environmental challenges. For more information, visit covanta.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may constitute "forward-looking" statements as defined in Section

27A of the Securities Act of 1933 (the "Securities Act"), Section 21E of the Securities Exchange Act of 1934 (the "Exchange Act"), the Private Securities Litigation Reform Act of 1995 (the "PSLRA") or in releases made by the Securities and Exchange Commission ("SEC"), all as may be amended from time to time. Forward-looking statements are those that address activities, events or developments that we or our management intend, expect, project, believe or anticipate will or may occur in the future. They are based on management’s assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments and other relevant factors. They are not guarantees of future performance or actual results. Developments and business decisions may differ from those envisaged by our forward-looking statements. Forward-looking statements, including, without limitation, statements with respect to the consummation of the transaction with EQT, involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Covanta Holding Corporation (“Covanta”), its subsidiaries and joint ventures or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements, in particular, the announced business combination with EQT depends on the satisfaction of the closing conditions to the business combination, and there can be no assurance as to whether or when the business combination will be consummated. For additional information see the Cautionary Note Regarding Forward-Looking Statements in the Company's 2020 Annual Report on Form10-K as well as Risk Factors in the Company’s most recent Quarterly Report on Form 10-Q for the period ended June 30, 2021.

Where to Find Additional Information

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed merger between Covanta and affiliates of EQT Infrastructure. In connection with the proposed merger, Covanta intends to file a proxy statement with the SEC. SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Security holders may obtain a free copy of the proxy statement (when available) and other documents filed by Covanta with the SEC at http://www.sec.gov.Free copies of the proxy statement, once available, and Covanta’s other filings with the SEC, may also be obtained from the respective companies. Free copies of documents filed with the SEC by Covanta will be made available free of charge on Covanta’s investor relations website at https://investors.covanta.com/.

Participants in the Solicitation

Covanta and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Covanta’s stockholders in respect of the proposed merger. Information about the directors and executive officers of Covanta is set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021. Stockholders may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the proposed merger when it becomes available.

Investor Contact

Dan Mannes

1.862.345.5456

IR@covanta.com

Media Contact

Nicolle Robles

1.862.345.5245